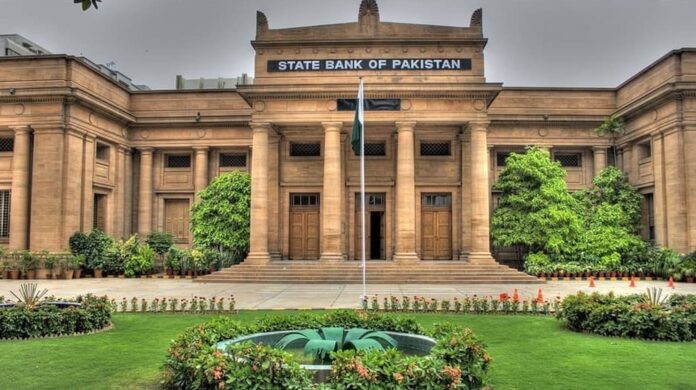

The State Bank of Pakistan (SBP) has issued guidelines for the downtime of digital banking channels, which means that all banks and financial institutions are now obliged to inform their customers about the upcoming downtime of the digital banking channels caused by unknown disruptions or scheduled maintenance in advance.

Guidelines for Downtime of Digital Banking Channels

1. In order to ensure that customers are informed about service disruptions due to any scheduled or unforeseen activity, the following instructions are being issued:

A) Customers and SBP must be informed about any planned activity which may result in the service disruption in the following manner:

- shall be informed at least two days in advance through various communication channels including but not limited to SMS alerts, social media platforms, in-app notifications etc.

- SBP shall be notified at least one week in advance as per Annexure-I.

- In any situation where downtime exceeds by more than two hours of its planned duration, then it should be immediately conveyed to the customers and reported to SBP.

B) In case of unanticipated service disruption for more than thirty minutes, due to any reason:

- must be immediately informed about any disruption of services through the aforementioned communication channels, together with an estimated time of restoration of services.

- SBP shall be notified as per the Annexure-II.

3. Customers and SBP shall also be informed once services have resumed as usual.

4. All Regulated Entities (RE) must establish mechanisms to continuously monitor social media platforms in order to proactively identify and address customer complaints or issues relating to the availability of digital channels.

5. SBP, as part of its oversight responsibility, will also be regularly monitoring the availability of digital channels.

6. Cumulative downtimes on a monthly basis shall be reported to SBP, as per Annexure-III. In case the unanticipated downtime exceeds more than three hours per quarter, SBP shall be informed about the steps taken by respective RE to avoid disruption in future.

The Online Banking Outage

Most of the time, social media is filled with numerous complaints from banking customers as they had to face humiliation due to the uninformed downtime of digital banking. Imagine shopping from an international brand, and at the time of bill payment, you get to know that digital banking services are unavailable; it would be a different level of disaster. SBP issuing the guidelines mentioned above was not only essential, but it is the need of the hour.

Also read: Digital Era: SBP Introduces Digital Banking Framework