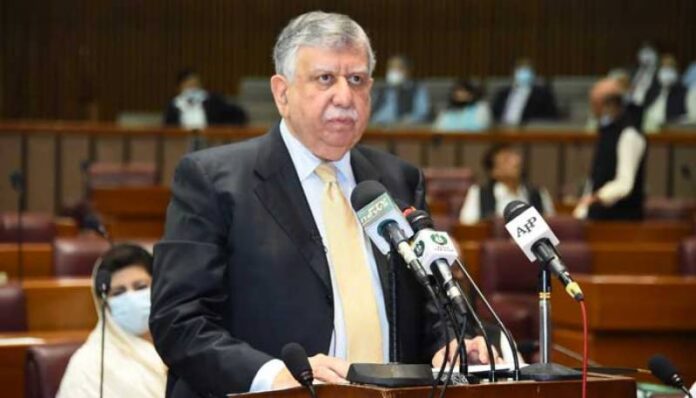

On Thursday, Finance Minister, Shaukat Tarin introduced in the National Assembly the Finance Supplementary Bill 2021 proposing withdrawal of sales tax exemptions worth Rs343 billion on luxury items including machinery, pharma, and imported food items. The bill also suggests an upsurge in rates of federal excise duty, income tax, and sales tax on services in the federal capital region.

Finance Supplementary Bill 2021 Suggests Raising Taxes on Luxury Items

Finance Minister Shaukat Tarin explained that sales tax on machinery and pharma sector is modifiable and refundable. He stated the levy of 17 percent sales tax on several hundred items, which would directly or indirectly influence the people, would grow almost Rs71bn for the national kitty.

The pullout of tax exemptions comprises Rs31bn on luxury items and Rs31bn on business goods. “Elites, not the common man, are beneficiaries of these exemptions,” Mr. Tarin said, adding that tax exemptions of Rs343bn had been benefiting various interest groups for the past 70 years. “We have targeted only those items which are used by the elites.”

Finance Minister Shaukat Tarin described that withdrawal of tax exemptions worth Rs112bn on machinery and Rs160bn on the pharmaceutical sector is adjustable and refundable. He did not consider these as taxes which will now be collected at the rate of 17pc on import of machinery and from the pharma sector.

17 Percent Tax Increase on High-End Products

The Finance Supplementary Bill proposes a 17pc sales tax on several items which were previously exempted from the tax. The state terms these products as luxury items which include import of live animals, steak meat, fish, vegetables, high-end bakery items, branded cheese, imported sausages, high-end cellphones, and import bicycles.

Read more: Government Eases Sales Tax on Local Electric Vehicles (EVs) from 17% to 1%

As per the finance minister, the 17pc sales tax imposed on the items used by common people would yield only Rs2bn for the government. These items comprise personal computers, sewing devices, matchboxes, iodized salt, red chili, and contraceptives.

In the agribusiness sector, the less rate of 2pc on fertilizer at out-stage will continue, along with numerous less rates on fertilizer inputs as presently available. According to Finance Supplementary Bill, sales tax exemption will continue on pesticides and tractors will continue to be traded at a 5pc tax rate.

Federal Excise Duty on Vehicles is to be Suggested by Tariff Policy Board

Federal excise duty on imported and locally manufactured/assembled vehicles is suggested to be raised on the suggestions of the Tariff Policy Board and the Ministry of Commerce. Advance tax on cellular services is suggested to be raised from 10pc to 15pc while withholding tax is submitted on foreign-produced TV serial/dramas and advertisements with foreign actors.

Finance Minister Shaukat Tarin in a briefing to the media told those creating a hue and cry over the Finance Supplementary Bill and the State Bank Pakistan (SBP) freedom bill were only politicizing the technical issue without any explanation. He also emphasized the significance of the SBP autonomy and said it was important for the general growth of the country’s economy.

The minister said the allegations being balanced against the government were unfounded because not every request of the IMF had been accepted in the SBP autonomy bill. “We need to understand that all those countries, which have not granted independence to their central banks, like Turkey, have suffered.”

Source: DAWN