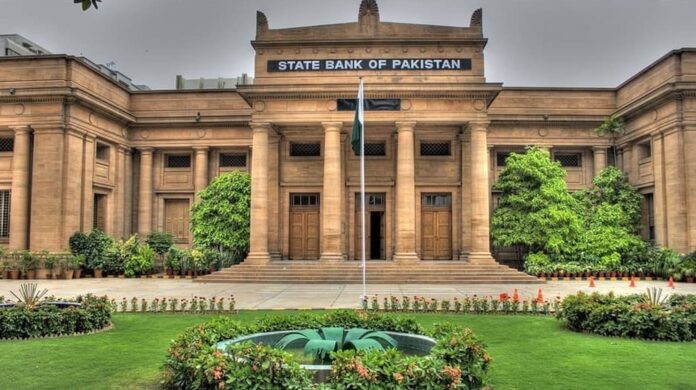

Foreign exchange reserves held by the State Bank of Pakistan (SBP) increased by $276 million to $3.19 billion in the week ending on 10th February. It should be noted that last week the foreign exchange reserves held by the SBP dropped to an alarming level of $2.92 billion owing to external debt repayments.

Foreign Exchange Reserves Increased Due to the Inflow of Dollars

The increase in the foreign exchange reserves is still unknown however market analysts suggest that the foreign exchange reserves have increased as the central bank bought US dollars from the inter-bank market. “Surplus supplies have encouraged the central bank to intervene (by buying dollars to strengthen the forex reserves),” a market commentator said.

The liquid foreign currency reserves held by the country, including the net reserves held by banks other than the SBP, stood at $8,702.2 million. The net reserves held by commercial banks amounted to $5,509.3 million. Experts believe that the resumption of the IMF loan program will provide much-needed support for stabilizing the foreign exchange reserves, help avert the looming risk of default and enhance the country’s capacity to pay for imports and repay foreign debt.

Pakistan Introduces Finance Bill to Unlock IMF Funds

The Pakistani government has tabled a 170 billion rupee finance bill to help secure the loan from the IMF. The bill includes a raise in the general sales tax by a percentage point to 18 percent and follows hikes in the price of fuel and gas. However, the government failed to sign a staff-level agreement with the IMF team but it is expected that the reforms introduced by the government will help secure the $1.1bn installment.

Also read: ECC Approves 124% Hike in Gas Tariff to Unlock IMF’s Deal